Live Chat: Get Answers, Solve Your Tax Problems Fast!

Our expert team offers immediate assistance with real-time answers to free you from the taxing stress. Whether it’s unfiled returns, back taxes, or any IRS-related issue, we're here to help! Our platform connects you directly with experienced tax professionals ready to provide free, one-on-one advice on navigating the complex world of IRS tax problems. Say goodbye to sleepless nights and the endless cycle of notices. With our live chat feature, you can receive guidance and support instantly—no more long waits! Don’t let IRS tax issues control your life. Join our live chat for instant support and start your journey towards a stress-free resolution. Watch now to find out how to tackle your tax concerns with ease! 🚀

Facing IRS tax issues? Empower yourself with the Tax Resolution Strategic Defense Course. Gain confidence to resolve tax problems effectively with expert insights and real-life examples. Take control of your tax situation right now!

Start Course

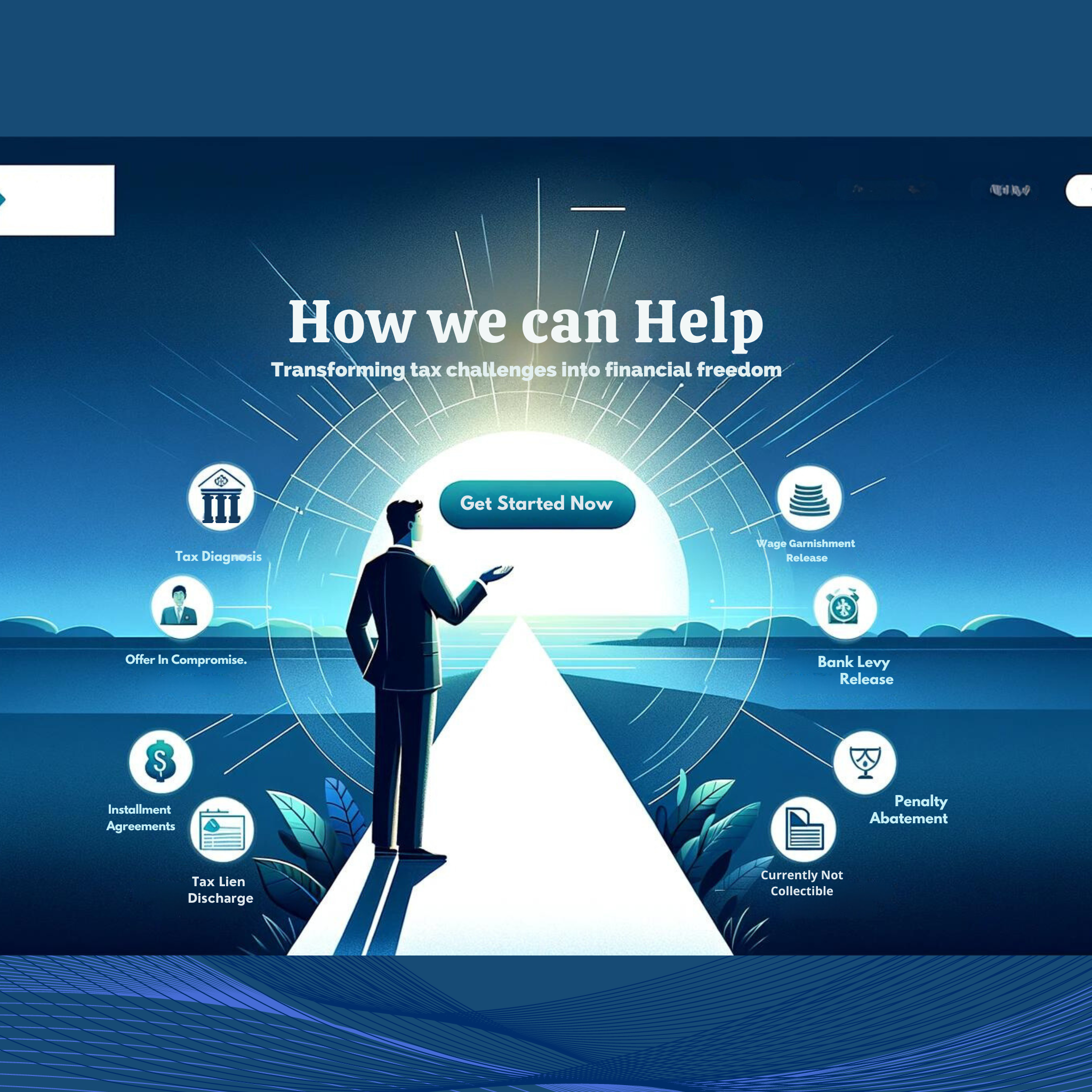

How We Can Help

-

Is the IRS Breathing Down Your Neck?

IRS problems hanging over your head like a dark cloud? Feel like navigating tax issues is like being lost at sea without a compass? You're not alone. But what if there was a way to get a bird’s-eye view of your situation, making those dark clouds a bit less ominous? That’s exactly what our Total IRS Tax Diagnosis is designed to do. Book an IRS Total Tax Diagnosis now and start turning chaos into clarity.

IRS Case Analysis: Your Strategic Defense Blueprint

Imagine trying to juggle flaming torches while blindfolded. That's what dealing with the IRS can feel like. But with our IRS Case Analysis, you’re not just throwing caution to the wind. You’re equipped, empowered, and accompanied by a team that’s navigated these treacherous waters before. Our analysis serves as the initial step in the resolution process

-

Offer in Compromise: Your Path to Settling IRS Debt for Less

Struggling with Overwhelming Tax Debt?

Facing a mountain of IRS debt can feel like being trapped in quicksand – the more you struggle, the deeper you sink. But what if there was a way to settle your debt for less than what you owe? An Offer in Compromise (OIC) might just be the lifeline you need.

What is an Offer in Compromise?

An Offer in Compromise is a powerful IRS program designed to help taxpayers settle their tax debt for less than the full amount owed. It’s not a magic wand, but it can be a strategic tool for those who qualify. Our team of experts will work closely with you to determine if an OIC is the right solution for your situation.

-

Is the IRS Taking a Chunk of Your Hard-Earned Money?

Having your wages garnished by the IRS feels like running a marathon with a ball and chain. Every paycheck diminishes, making it hard to keep up with your living expenses. But there’s hope. Our Wage Garnishment Release service is designed to help you reclaim your paycheck and restore your financial freedom.

What is Wage Garnishment?

Wage garnishment is a powerful tool the IRS uses to collect unpaid taxes directly from your paycheck. They can legally seize a significant portion of your earnings, leaving you struggling to cover basic expenses. But this doesn’t have to be your reality.

-

Bank Levy Release: Unlock Your Frozen Accounts and Regain Financial Control

Is the IRS Freezing Your Bank Accounts?

Imagine waking up one morning to find your bank accounts frozen, your funds inaccessible, and your financial world turned upside down. An IRS bank levy can do just that, leaving you feeling helpless and desperate. But there’s a way to thaw those frozen accounts and regain control. Our Bank Levy Release service is here to help you unlock your funds and restore your financial freedom.

What is a Bank Levy?

A bank levy allows the IRS to legally seize the funds in your bank account to satisfy unpaid tax debts. This drastic measure can freeze your assets, making it impossible to cover your daily expenses or manage your financial obligations. But don’t despair – there are ways to lift the levy and protect your hard-earned money.

-

Penalty Abatement: Reduce or Eliminate IRS Penalties and Breathe Easier

Are IRS Penalties Adding Insult to Injury?

Imagine facing not only a hefty tax bill but also the added burden of penalties and interest piling up. It’s like trying to climb a mountain with a backpack full of rocks. But what if there was a way to lighten that load, to reduce or even eliminate those penalties? That’s where our Penalty Abatement service comes in, offering you a path to financial relief.

What is Penalty Abatement?

Penalty abatement is a provision that allows taxpayers to request the reduction or removal of IRS penalties for a variety of reasons, such as reasonable cause, administrative waivers, or statutory exceptions. It’s not a guarantee, but with the right approach, you can significantly reduce your financial burden.

-

Innocent Spouse Relief: Protect Yourself from Unfair IRS Liability

Are You Unfairly Held Liable for Your Spouse’s Tax Issues?

Imagine being blindsided by a hefty tax bill due to your spouse or ex-spouse's financial missteps. It feels like getting hit by a truck you never saw coming. But there’s hope. Our Innocent Spouse Relief service can help shield you from unfair liability and restore your peace of mind.

What is Innocent Spouse Relief?

Innocent Spouse Relief is an IRS provision designed to protect individuals from being unfairly held responsible for their spouse or ex-spouse's tax liabilities. If you meet the criteria, you could be relieved from paying additional taxes, interest, and penalties related to your spouse's errors or omissions.

-

IRS Installment Agreements: Manage Your Tax Debt with Affordable Payments

Overwhelmed by IRS Debt?

Facing a massive IRS tax bill can feel like being buried under a mountain of debt, with no way to climb out. But what if I told you there’s a way to manage that debt with affordable, manageable payments?

An IRS Installment Agreement can be your lifeline, providing a structured way to pay off your tax debt without the constant fear of aggressive collection actions.What is an IRS Installment Agreement?

An IRS Installment Agreement is a payment plan that allows taxpayers to pay off their tax debt over time in manageable monthly installments. Instead of a lump-sum payment, you get the flexibility to pay down your debt in a way that fits your budget.

-

Currently Not Collectible Status: Pause IRS Collections and Regain Your Financial Footing

Drowning in Tax Debt with No Relief in Sight?

Picture this: you’re already struggling to make ends meet, and then the IRS comes knocking, demanding payments you simply can’t afford. It feels like you’re stuck in quicksand, with no way out. But what if there was a way to press pause on the IRS collections? Enter Currently Not Collectible (CNC) status, a lifeline for those in financial hardship.

What is Currently Not Collectible Status?

Currently Not Collectible (CNC) status is a special designation by the IRS acknowledging that you cannot pay your tax debt due to financial hardship. When granted CNC status, the IRS temporarily halts all collection activities, including levies and garnishments, allowing you to focus on getting back on your feet.

-

Partial Pay Installment Agreement: Settle Your IRS Debt for Less

Burdened by Overwhelming Tax Debt?

Imagine carrying the weight of a massive tax bill on your shoulders, with no end in sight. It feels like being trapped in a financial prison. But what if I told you there’s a way to negotiate a deal with the IRS to pay less than you owe? A Partial Pay Installment Agreement (PPIA) might be the key to unlocking that financial freedom.

What is a Partial Pay Installment Agreement?

A Partial Pay Installment Agreement (PPIA) is a payment plan that allows you to settle your tax debt for less than the full amount owed. Unlike traditional installment agreements, PPIAs are based on your ability to pay, often resulting in a significant reduction in the total amount paid over time.

-

IRS Collection Statute of Limitations: Know Your Rights and Expiration Dates

Feeling Like Your Tax Debt Will Haunt You Forever?

Living under the shadow of IRS debt can feel like a life sentence, with no end in sight. But what if I told you that there’s a light at the end of the tunnel? Understanding the IRS Collection Statute of Limitations could be your key to freedom. Yes, even the IRS has a time limit on how long they can pursue you for unpaid taxes.

What is the IRS Collection Statute of Limitations?

The IRS Collection Statute of Limitations is a legal time limit, typically 10 years, during which the IRS can collect unpaid taxes. Once this period expires, the IRS can no longer legally enforce collection of the debt, providing a potential pathway to relief for many taxpayers.

-

Tax Lien Discharge: Clear Your Property and Restore Your Financial Freedom

Is a Tax Lien Holding Your Property Hostage?

Imagine trying to sell or refinance your home, only to find that a tax lien is standing in your way. It feels like being trapped, with your financial options limited and your future plans put on hold. But there’s a way to break free. Our Tax Lien Discharge service can help you remove that lien and regain control of your property and finances.

What is a Tax Lien Discharge?

A tax lien discharge removes the IRS's claim on a specific piece of property, allowing you to sell or refinance it without the tax debt getting in the way. This process can be complex, but with the right guidance, you can successfully navigate it and clear the path to your financial goals.

-

US Passport Suspension: Protect Your Right to Travel and Resolve Your Tax Issues

Is Your Passport at Risk Due to Tax Debt?

Imagine planning a trip only to discover that your passport is suspended because of unpaid taxes. It feels like hitting a brick wall, with your freedom to travel suddenly stripped away.

But there’s a way to protect your passport and resolve your tax issues. Our US Passport Suspension service can help you maintain your travel rights and address your tax debt effectively.

What is US Passport Suspension?

The IRS has the authority to request the suspension or revocation of your US passport if you owe a significant amount of tax debt (typically $54,000 or more). This measure is part of the IRS’s enforcement strategy, but it can be challenged and resolved with the right approach.

Welcome to Long Island Tax Solutions!

Our team of experienced tax professionals is dedicated to resolving your IRS tax problems and guiding you to financial freedom. We understand that an IRS audit or tax debt can be overwhelming, which is why we handle your case with the utmost care and urgency. Our customized tax resolution strategies are designed to minimize penalties and negotiate the lowest possible tax settlement or payment plan on your behalf. We thoroughly analyze your situation to identify any missed deductions or credits that could reduce your tax liability. Our goal is not only to resolve your immediate tax issues, but also provide ongoing tax planning and advice to avoid future problems. We aim to establish long-term relationships with our clients built on trust and excellent service. If you're struggling with back taxes or an IRS audit, contact us today to schedule a confidential consultation. Our dedicated team will conduct a comprehensive review of your situation and recommend solutions that can finally put your tax problems behind you.